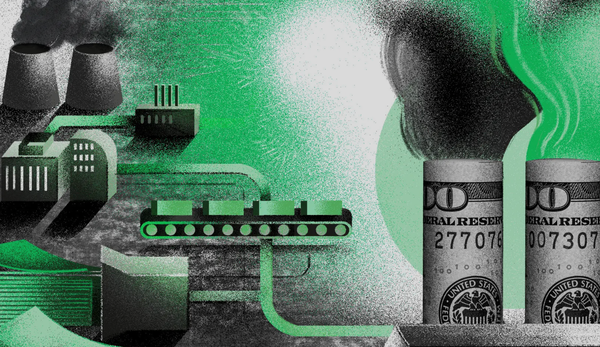

How mega-polluters take advantage of billions in green loans

Shell got one. So did the pipeline company Enbridge. And last summer, energy giant Drax got its biggest one to date, worth more than half a billion dollars.

Sasha Chavkin is a senior reporter for The Examination, where he covers the food industry. He specializes in cross-border investigations and environmental and public health issues.